512.904.9900

Public Adjusters

Claim Assistance Available 24/7

"Leaky Roof? Get It Fixed Fast – Book a Free Inspection Today!"

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Are you tired of hearing that [Common Belief] is the only way to achieve [Desired Result]? What if we told you there’s a faster, simpler way to get the results you want, without the stress and hassle of [Common Belief]?

Licensed & Insured Roofing Experts

Lifetime Warranty on Materials

Fast, Free, No-Obligation Inspections

Certified Roofing Company

Hail Damage? We Fight for Your Maximum Settlement.

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Don’t Let the Insurance Company Undervalue Your Claim – We Maximize Your Settlement

Licensed Insurance Policyholder Advocates

500+ Satisfied Policyholders and Counting

Non-Litigious Solutions

Over $250,000,000 Recovered

INSURANCE COMPANIES HAVE EXPERTS WORKING FOR THEM. YOU SHOULD, TOO!™

Don’t Settle for Less — Texas' Trusted Large-Loss Hail Claim Public Adjusters

Texas Hail Damage Insurance Claim?

Get the Settlement You Deserve

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

"Don't let small leaks turn into big problems. Schedule your no-obligation inspection and protect your home from costly damage."

Fast, Free, No-Obligation Inspections. We’ll Be in Touch Within 24 Hours!

Apartment & Multifamily Hail Damage Claim Experts

Commercial Building

Hail Damage Claim

Luxury Home Hail Damage Claim Specialists

20+

Years Of Experience

500+

Large-Loss Claims Settled

130,160

Hours Worked

$450,000

Average Claim Amount

Struggling With?

Initial Hail Claims

When hail damages your commercial, multifamily, or residential property in Texas, filing the initial insurance claim timely and properly is crucial.

Large-loss hail insurance claim is high-stakes — and ICRS public adjusters ensure your initial claim is complete, accurately documented, and aggressively represented, maximizing your chances of a full and fair settlement from the start.

Underpaid Hail Claims

Insurance companies often underpay hail claims, offering low settlements that don’t cover the scope of damage.

ICRS identifies overlooked damages, undervalued estimates, and coverage gaps.

We routinely represent policyholders to re-open, negotiate, and supplement underpaid claims.

Denied Hail Claims

Some, insurers outright deny hail claims, citing policy exclusions, pre-existing conditions, or inadequate proof of damage. A wrong date of loss, improper inspection, or reliance on unsubstantiated expert opinions vs. facts can also contribute to wrongfully denied claim.

Get a 2nd opinion. Our experience overturning wrongfully denied hail claims can help you too.

Delayed Hail

Claims

Delayed insurance claims are a common tactic used by insurers to pressure property owners into accepting lower settlements or giving up entirely.

ICRS expedites the claim process by compelling insurer's to perform. We hold them accountable pursuant to your policy and statutes. Put our expertise to work and break through insurer stall tactics—so you get settled faster.

Large Loss Hail Claim Experts

Don’t Let Hail Damage Cost You Thousands—We Fight for Maximum Payouts

Hailstorms wreak havoc on commercial properties, but insurance companies often undervalue or delay payouts. We make sure policyholders receive every dollar they’re owed.

Recover more for your storm damage claim.

Fast, strategic, and expert-backed insurance claim solutions.

Get a hail damage claim review today—don’t leave money on the table

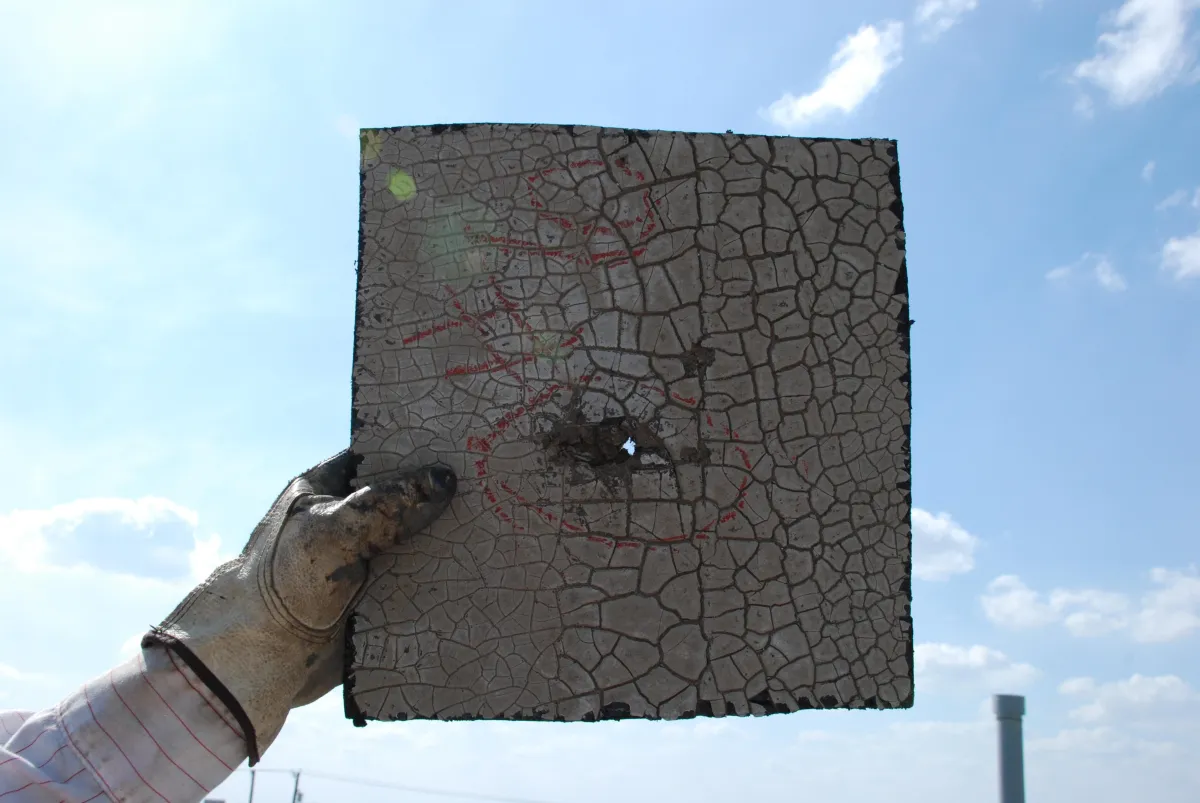

TPO Experts

Was Your Hail Claim Denied or Underpaid?

Get the Settlement You Deserve!

If your claim has been delayed, denied, or lowballed, it’s time to take action. Insurance carriers often dispute hail damage claims—but we have the expertise to prove the real extent of your losses.

Public Adjusters for Commercial & Multi-Family Claims

We Fight Insurance Tactics That Reduce Payouts

Helping Policyholders Recover Fair and Prompt Settlements

35 + Successful Projects

Local Roofing Experts

100% Guarantee

Hail Claim Results For Policyholders

ICRS Advocates For Policyholders

No Recovery, No Fee*

We don’t get paid unless you do.

Proven Results

Successfully settled hundreds of millions in property damage claims.

Expert Representation

500+ large-loss claims settled fairly & promptly.

Avoid Unnecessary Litigation

We maximize settlements without unnecessary legal battles.

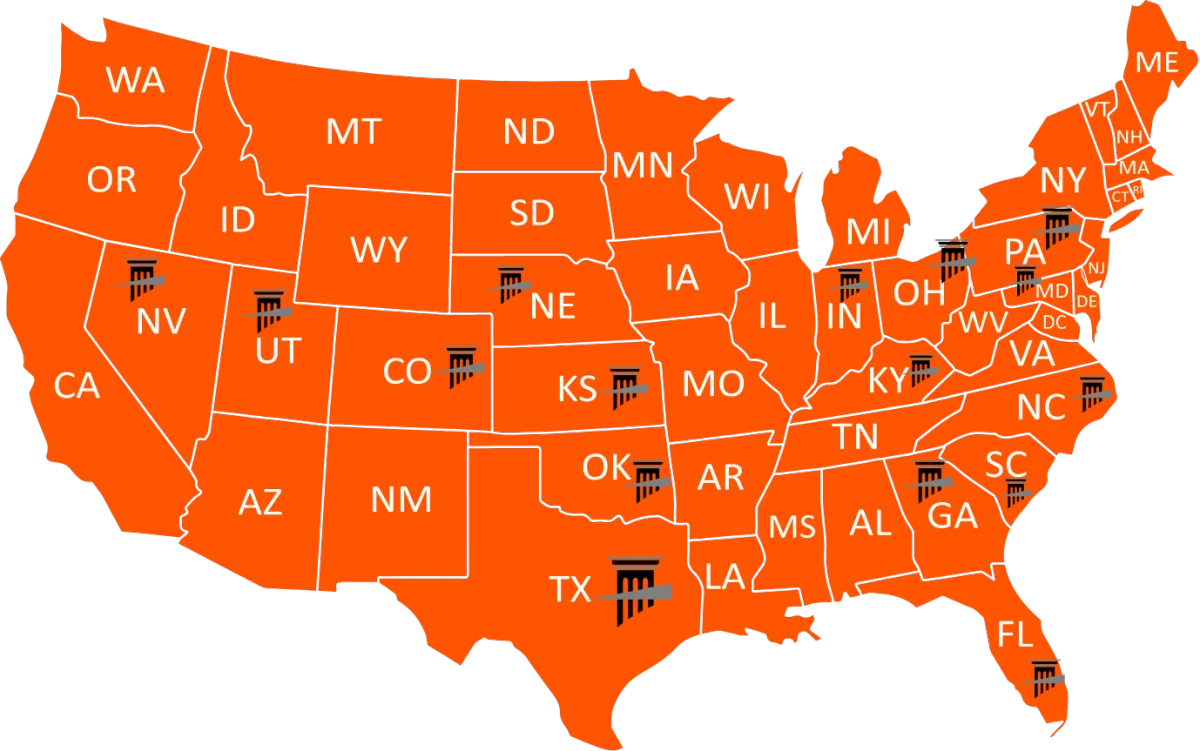

Licensed Public Adjusters Nationwide

We work exclusively for policyholders, not insurers.

Verifiable Success

Increased settlements over initial offers by 20% to 3,830%+

Licensed Public Adjusters In 16 States:

The Nations Leading Hail Damage Claim Specialists

Texas Hail Claim Denied or Underpaid?

If your claim has been delayed, denied, or lowballed, it’s time to take action. Insurance carriers often dispute hail damage claims—but we have the expertise to prove the real extent of your losses.

Storm and wind damage

Public Adjusters for Commercial Flat Roof Buildings & Multi-Family Pitched Roof Claims

Asphalt Shingles

Modified Bitumen

Tile

Tar and Gravel

Metal

We Fight Insurance Tactics That Reduce Payouts

Helping Policyholders Recover Full Indemnification

Was your claim was underpaid?

Schedule a review today.

Certified Commercial Roof Inspector

Texas' Trusted Hail Storm Insurance Claim Experts

HAAG-Certified & Ready to Help

Navigating a large hail damage claim? Our HAAG-certified adjusters specialize in identifying storm-related losses insurers often overlook. We ensure Texas business owners get the full value of their policies—no excuses, no delays.

Industry-Leading Experts in Commercial Roof Claims

We Challenge Underpaid & Denied Claims

Detailed Roof Inspections That Stand Up to Insurance Scrutiny

Storm Specialists

Texas' Trusted Storm Claim Experts—HAAG-Certified & Ready to Help

Navigating a large hail damage claim? Our HAAG-certified adjusters specialize in identifying storm-related losses insurers often overlook. We ensure Texas business owners get the full value of their policies—no excuses, no delays.

35 + Successful Projects

Local Roofing Experts

100% Guarantee

Build Roof Standard

Licensed & Insured

Providing Quality

Leaks and water damage

Why Choose ICRS TESTIMONIALS

Hear what Our Clients are saying

"Thank you Scott"

Scott responded to my inquiry and took the time to listen and understand our unpleasant experience dealing with our insurance claim. Although I did not utilized his service, he gave me a sound, professional advice and offered to help when he referred me to his engineer. They replied promptly and I was able to have better understanding of the situation. Thank you Scott!

- Haidee J.

"I would highly reccomend"

Words can’t describe how grateful we are for the consultation and claim evaluation we had with Scott. Full disclosure we were unable to work with him due to limitations of our scope. We wanted to properly recognize Scott for the honest and genuine passion he put in to not only our claim, but the way he runs his business in general. We hadn’t had such clarity of next steps since this began in 2020. I would highly recommend this business to everyone spinning their wheels in this process!

- James M.

"I came across this company and had none of those bad feelings"

This was not the first public adjuster I called. I called a different company first but they gave me a bad feeling on the phone. Too aggressive. Didn't feel trustworthy to me. So, I kept looking. I came across this company and I had none of those bad feelings. Scott, the guy who took my call, seemed very knowledgeable and I felt I could fully trust him. As it turned out, he told me that my claim was fairly simple and I didn't need the full scope of his service and fees. But, without charging me a fee, he gave me some needed advice on this whole matter of insurance claims which I needed. And told me I could call him back to ask another question or two if necessary. I would recommend this company for these services.

- Katie H.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’re serious about [Desired Result] and want a quick, easy-to-follow guide to get there.

You’re struggling with [Common Pain Point] and need a clear path to [Desired Outcome].

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

You’ve tried other solutions but haven’t seen results and are ready for a proven approach.

ATTENTION: TARGET AUDIENCE

How To Desire Without Doing Z To Achieve Goal

Download the free report and take your marketing to the next level

Unsure If you need a public adjuster?

Frequently Asked Questions

What should I do immediately after a large-loss Hail Claim in Texas?

If your commercial or multi-family property in Texas has suffered hail damage, taking the right steps immediately can protect your claim and maximize your settlement.

Understand Your Policy Obligations

Your insurance policy outlines specific duties you must fulfill after a hail loss, including documenting damage, preventing further loss, and filing your claim promptly.

Act Quickly to Minimize Risk & Liability

Delays in addressing damage can lead to increased repair costs and insurance disputes. Moisture intrusion, structural weakening, and further exposure can jeopardize your claim.

Don’t Let the Insurance Company Dictate Your Settlement

Insurance carriers may undervalue, delay, or deny hail claims. If you're not getting the answers you need, seek professional claim assistance to ensure you receive the full payout you’re owed.

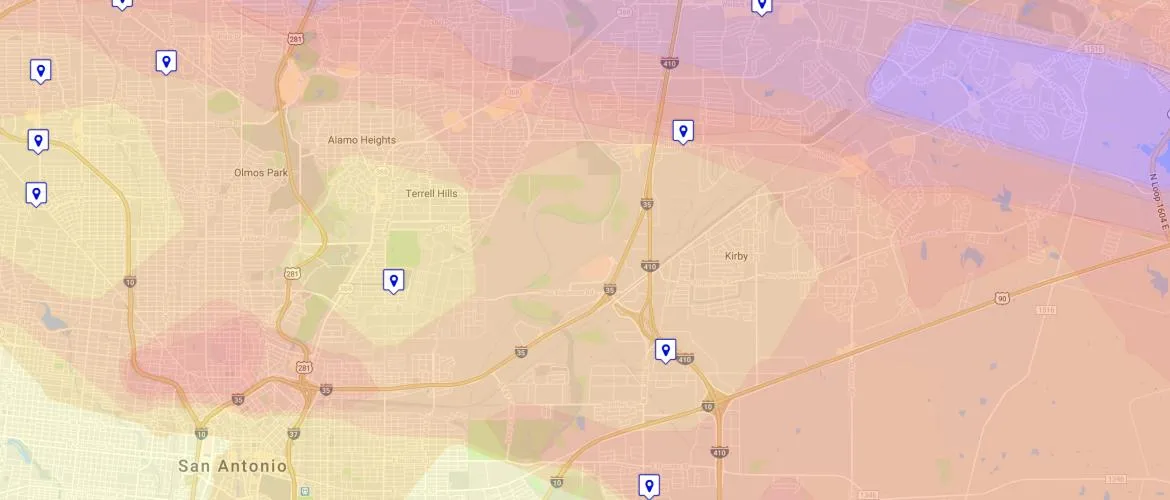

Get Expert Help Now

Our Dallas hail claim specialists help policyholders navigate complex insurance policies and recover maximum compensation. Schedule Your Free Claim Review Today.

What qualifies as a "large-loss" storm claim?

A large-loss storm claim typically refers to insurance claims exceeding $250,000 in property damage, often involving commercial buildings, multi-family properties, and high-value assets affected by severe weather events such as hailstorms, hurricanes, and tornadoes.

Key Factors That Define a Large-Loss Claim:

Significant Structural Damage – Roof destruction, window breakage, water intrusion, and facade impact.

Widespread Property Loss – Multiple buildings, large commercial facilities, or apartment complexes.

Extensive Business Interruption – Loss of revenue due to operational shutdowns caused by storm damage.

Complex Claim Negotiations – Insurers often dispute the full extent of large-loss claims, requiring expert representation.

Why Acting Fast Matters

Understanding your contractual obligations as a policyholder and the responsibilities your insurance provider owes you is crucial to avoiding unnecessary liability and risk. If your insurance company is delaying or undervaluing your claim, don’t wait. The longer damage remains unaddressed, the greater the risk of moisture intrusion, structural weakening, and increased liability.

Need Expert Help? Our large-loss claim specialists ensure you recover the full compensation you deserve. Schedule a Free Claim Review Today.

What if my hail damage claim was underpaid?

If your insurance company didn’t pay enough to cover the full extent of your hail damage repairs, you’re not alone. Insurance carriers often undervalue claims, misclassify damage, or use loopholes to reduce payouts. However, you have options to fight for the compensation you deserve.

Why Do Insurance Companies Underpay Hail Damage Claims?

Lowball Estimates – Insurers often undervalue repair costs, leaving property owners paying out of pocket.

Improper Damage Assessments – Adjusters may overlook structural issues or claim damage is "cosmetic" to reduce payouts.

Depreciation & Policy Exclusions – Some policies factor in wear and tear to justify lower settlements.

How to Fight Back & Recover What You’re Owed

Get an Independent Claim Review – A second opinion from an expert public adjuster or claims specialist can uncover missed damages and undervalued repairs.

Demand a Reassessment – You have the right to challenge your insurance company’s payout if it doesn’t align with policy coverage.

Work with Hail Claim Experts – Professionals who specialize in large-loss hail claims can negotiate for a higher settlement and ensure you’re fully compensated.

Don’t Let the Insurance Company Shortchange You

Understanding your policyholder rights is key to protecting your property and financial investment. If your insurer isn’t paying what they owe, take action now. The longer you wait, the harder it becomes to dispute the claim.

Need Help? Our team of hail damage claim specialists has helped Dallas policyholders recover millions. Get a Claim Review Today.

Can I dispute my hail damage claim payout?

Yes, if you believe your insurance company has undervalued, delayed, or denied your hail damage claim, you have the right to dispute the payout. Many policyholders in Dallas face lowball settlements, overlooked damage, or improper claim denials, but there are steps you can take to fight for the compensation you deserve.

When Should You Dispute a Hail Damage Claim?

The insurance company did not account for all damages to your roof, windows, or exterior.

Your payout is significantly lower than contractor estimates for necessary repairs.

The insurer claims pre-existing damage or uses policy loopholes to reduce the settlement.

The claim process has been delayed or denied without a clear explanation.

How to Dispute an Underpaid or Denied Hail Damage Claim

1. Review Your Policy – Check your policy to understand your coverage limits, deductibles, and exclusions.

2. Get a Second Opinion – A licensed public adjuster or independent roofing expert can assess whether your damages were fully accounted for.

3. Request a Reassessment – You can formally dispute the insurer’s estimate by providing additional documentation and requesting a second inspection.

4. File an Appraisal or Appeal – Many policies allow for an appraisal process, where a neutral third party helps settle claim disputes.

5. Seek Professional Assistance – If your claim is still undervalued, a claims advocate or legal expert can negotiate on your behalf.

Take Action Before It’s Too Late

Insurance companies may set deadlines for disputing claims, so it’s important to act quickly. If your hail damage claim was underpaid, do not settle for less than you are owed. Our team of hail claim specialists has helped Dallas policyholders recover full payouts.

Request a Free Claim Review Today.

Do I need a Public Adjuster if I have already received my settlement?

Yes, even if you have already received a settlement, a public adjuster can help determine if you were underpaid and whether you are entitled to additional compensation. Insurance companies often undervalue claims by overlooking damages, applying depreciation, or using restrictive policy interpretations. If your settlement does not fully cover the cost of repairs, you still have options.

Why Hire a Public Adjuster After Receiving a Settlement?

Settlement Review – A public adjuster can analyze your claim to ensure the insurance company accounted for all damages and provided a fair payout.

Supplemental Claims – If additional damage is found or your initial payout was insufficient, a public adjuster can negotiate for a higher settlement.

Reopening a Claim – Many policies allow claims to be reopened within a certain time frame, especially if new damages become evident.

Independent Damage Assessment – Insurance adjusters work for the insurance company, while a public adjuster represents your best interests.

When Should You Consider a Public Adjuster?

Your settlement does not fully cover repair costs.

You suspect the insurance company undervalued or missed damage.

You were told certain damage is not covered, but you are unsure if that is accurate.

You want an expert to handle negotiations and maximize your recovery.

Its best to act quickly with the best support by your side

Insurance policies often have strict deadlines for filing supplemental claims or reopening a claim. If you believe your hail damage settlement was too low, consulting a public adjuster could help you recover the full amount you are owed.

Get a Free Settlement Review Today.

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

AGENCY PUBLIC ADJUSTER LICENSES

MISTY'S PUBLIC

ADJUSTER LICENSES

SCOTT'S PUBLIC ADJUSTER LICENSES

Our Large Loss Specialties

Contact Us

LEGAL

Copyright 2025. ICRS LLC. All Rights Reserved.